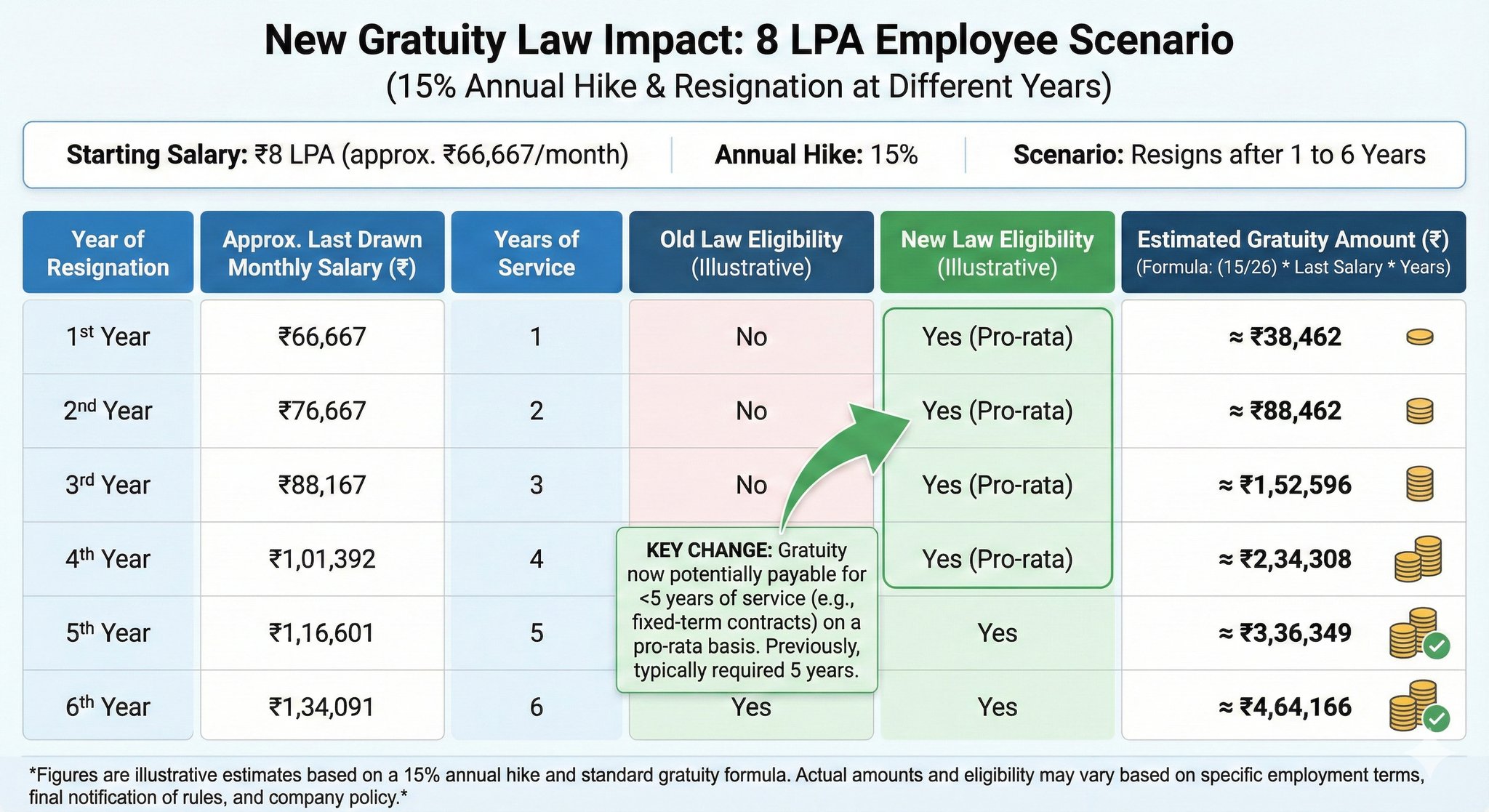

Fixed-term employees can now receive gratuity after just one year of continuous service with the same employer, earlier, the minimum requirement was five years.

If you join a company on a 12-month contract, you become eligible for gratuity once the contract ends.

This rule works even if you often change jobs or take up short-term assignments, ensuring you don’t lose out on benefits.

If your last basic monthly salary is Rs 50,000, your one-year gratuity works out to about Rs 28,846, calculated as: Rs 50,000 × (15/26) × 1 year.

Your payout increases automatically if you work for more than one year under the same employer.

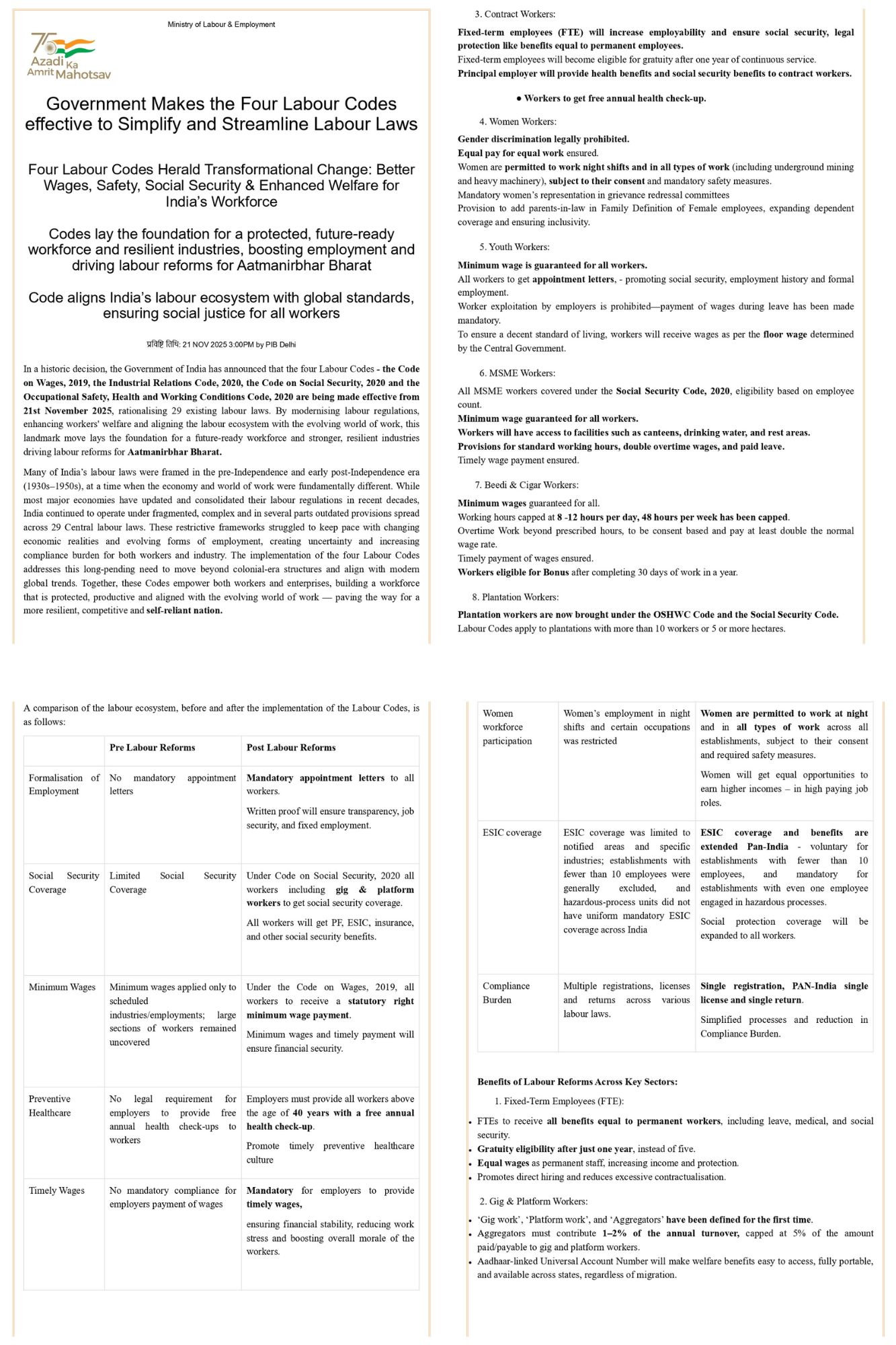

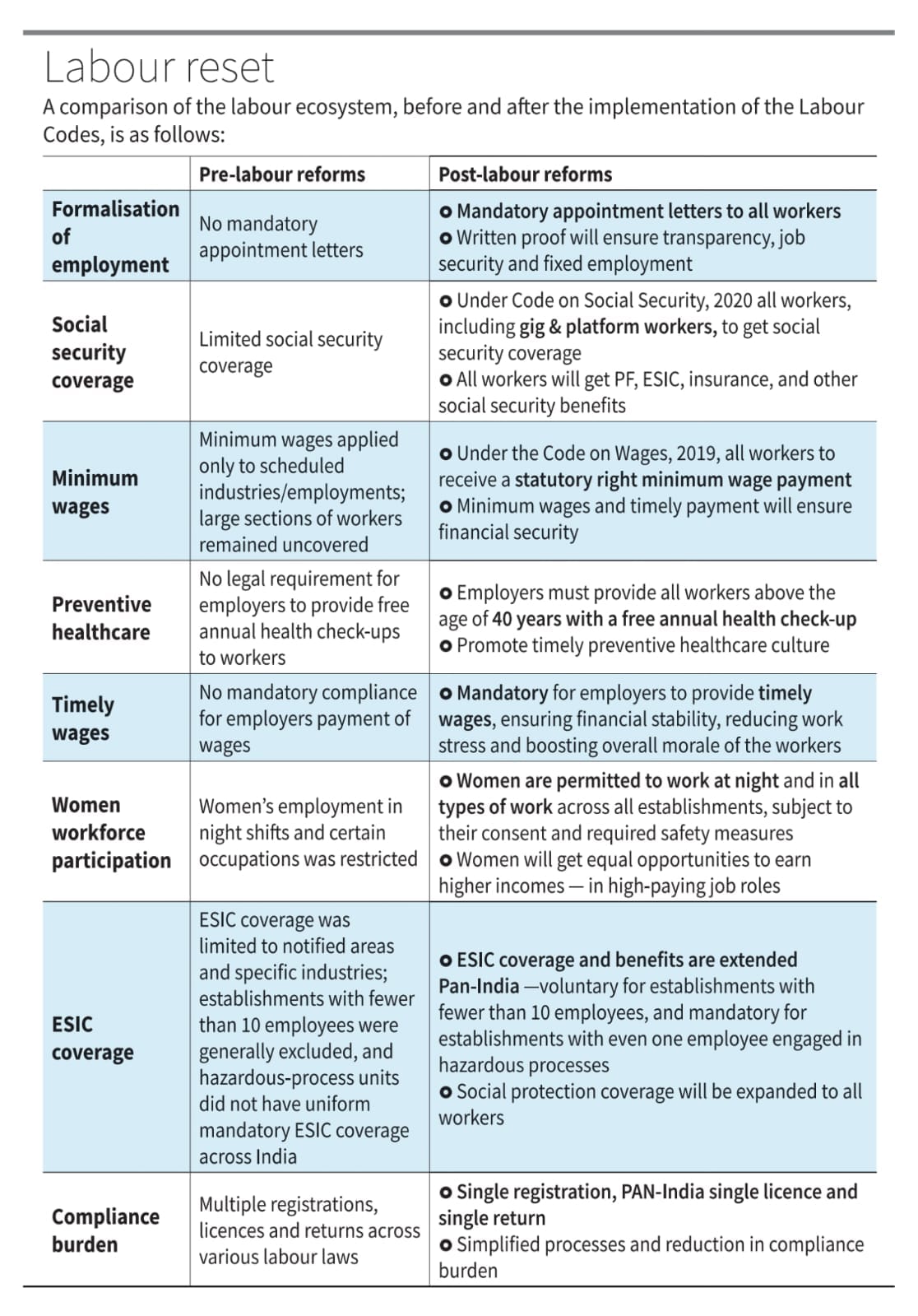

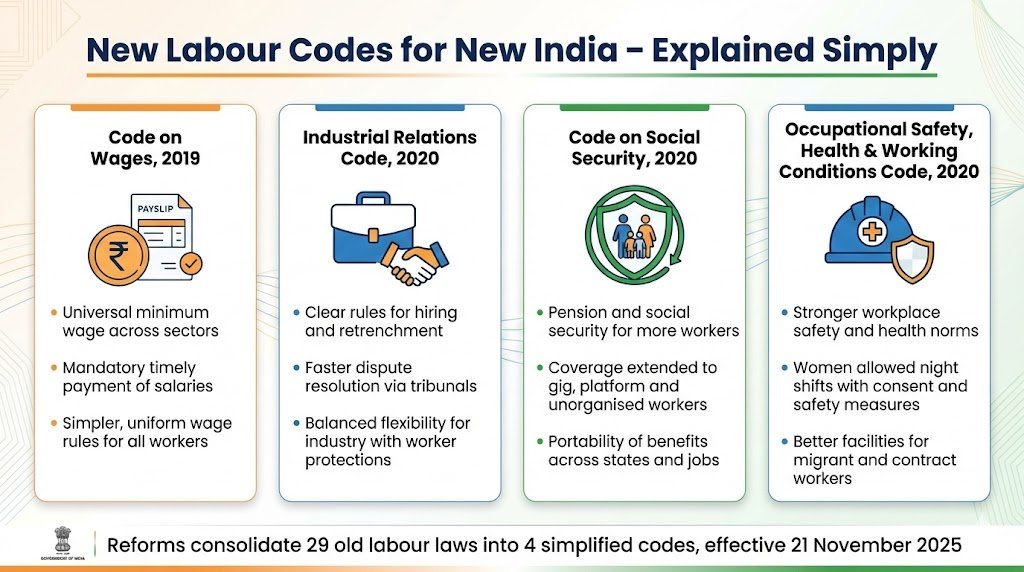

Boost for Contract & Gig Workers: The rule gives financial support earlier, especially to those who work on temporary contracts or project-based roles.

Short Stay, Still Get Paid: Workers who don’t stay long in one job can finally receive benefits they were earlier excluded from.

Permanent Employee Rule Unchanged: Full-time, permanent employees still need five years of continuous service to claim gratuity.

Gig Workers Included Under Law: New labour codes recognise gig workers and extend benefits like insurance and gratuity, even without a traditional employer-employee relationship.

More Stability for Gig Economy: Delivery workers, ride-hailing drivers, freelancers and other gig workers get an added layer of financial security after a year of work.