Business reporter, BBC News

Getty Images

Getty ImagesHigher water and energy bills are set to push up inflation “quite sharply” later this year, according to the Bank of England.

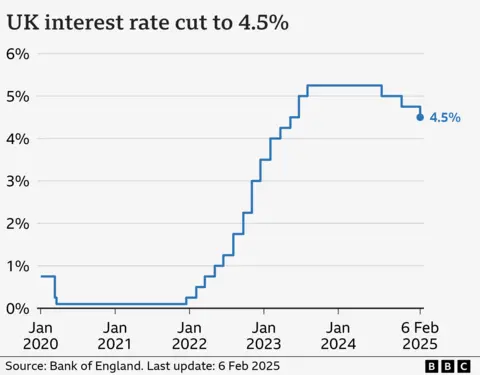

Its prediction came as the Bank cut interest rates to 4.5% from 4.75% as expected.

Rising bills mean inflation – the rate at which prices rise – will take longer to fall back to the Bank’s 2% target.

In a blow for the government, the Bank also halved its growth forecast for this year, although it predicted a recession would be narrowly avoided.

The government has made the growing the economy one of its key policies and last week the chancellor announced a number of measures to try to boost the UK’s performance.

But the Bank now predicts the economy will grow by 0.75% this year, down from its previous estimate of 1.5%.

Inflation is forecast to rise briefly to 3.7% later on this year and while the Bank expects it to ease, it will take until the latter part of 2027 instead of earlier that year to fall back to the 2% target.

The Bank said it would take a cautious approach to future interest rate cuts as it weighs up a number of factors that could affect inflation, including threats of trade tariffs from US President Donald Trump.

“We’ll be monitoring the UK economy and global developments very closely and taking a gradual and careful approach to reducing rates further,” said Bank of England governor Andrew Bailey.

“Low and stable inflation is the foundation of a healthy economy and it’s the Bank of England’s job to ensure that.”

Chancellor Rachel Reeves said the interest rate cut was “welcome news”.

“However, I am still not satisfied with the growth rate. Our promise in our Plan for Change is to go further and faster to kickstart economic growth to put more money in working people’s pockets.”

In its quarterly inflation report, the Bank said economic growth had been “broadly flat since March last year”.

The UK economy showed zero growth between July and September.

For the following three months, the Bank of England now expects it to shrink by 0.1% against a previous forecast for 0.3% growth.

A recession is defined as two back-to-back three-month periods of economic contraction.

For the first three months of this year, the Bank now expects the economy to grow by just 0.1%, down from its 0.3% forecast published last November.

The latest official growth figures for the UK economy will be published next Thursday.