Retro is back, again.

Fashion, like so much else, seems to pass through circles in time and, right now, plenty of the brands that those growing up in the 70s, 80s or 90s might remember are back in the shops and on the streets.

They’re not just having a mini-revival, though.

Top CEOs of multi-billion dollar corporations identify with the lasting power of these brands, not just their fleeting reappearance.

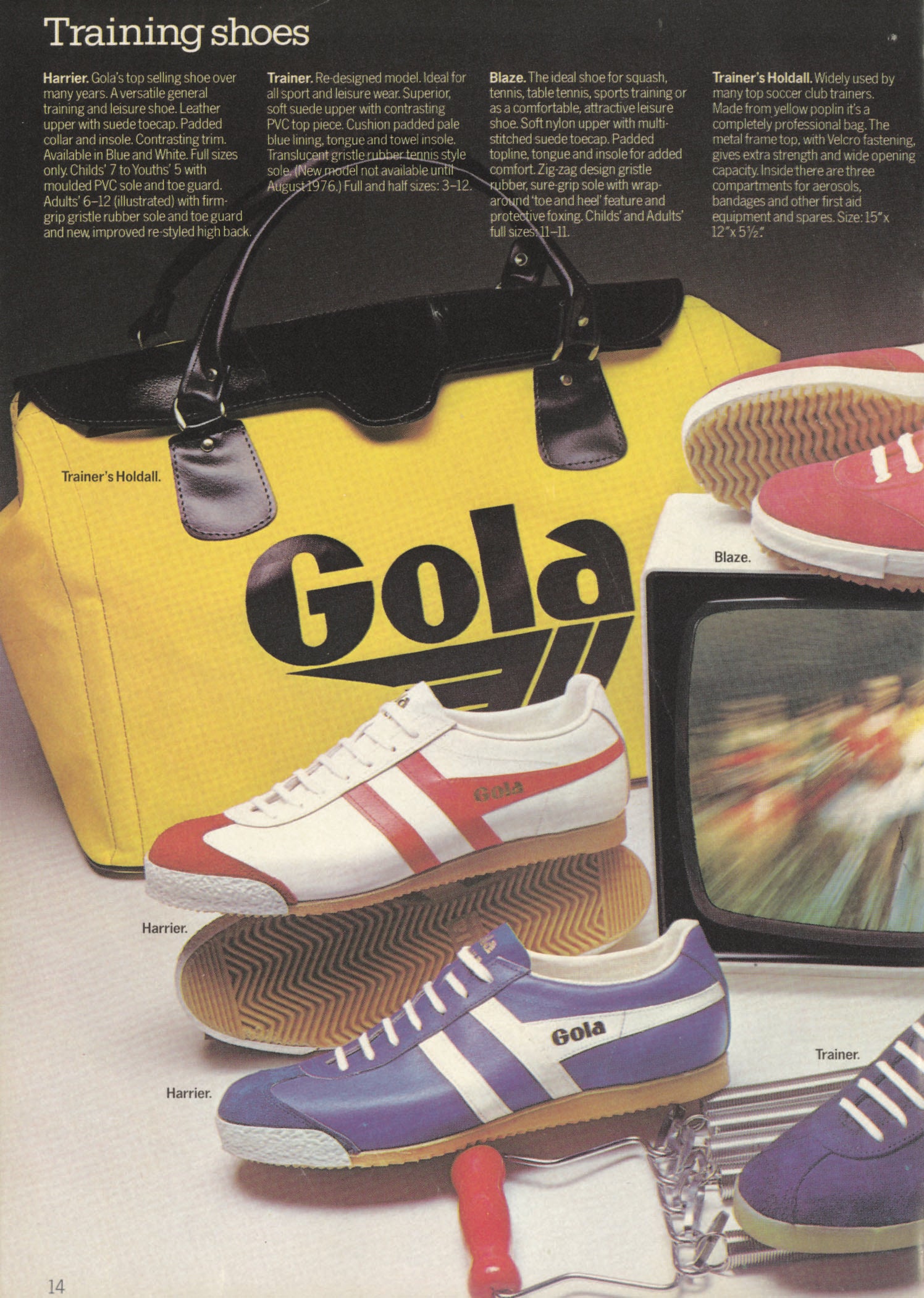

It’s a big part of the reason one iconic British brand has just been bought up: Gola.

The purchase last month was part of a wider acquisition which saw a Japanese firm, Marubeni, buy up the Jacobson Group, which also owned, or held licences, to the likes of fellow footwear brands, Lonsdale and Dunlop.

And it’s a deal which could, in time, see Gola be a front and centre brand once more on home soil – but also wider afield.

Who is Marubeni?

It’s worth noting that while Jacobson was a large family-founded firm, the company which has now bought them out is an altogether different beast.

The Financial Times, which is owned by Japanese media group Nikkei, reported the buyout was for more than $64m (£46m); there are no publicly released details of the purchase, but those close to the deal have reaffirmed toThe Independent a similar amount.

Marubeni Corporation, on the other hand, is a publicly listed company in Tokyo, valued by market capitalisation at 8.7tn yen – that’s around $56bn (£41bn). For context, that’s around the size of the bank Standard Chartered, or the business which owns the UK’s own major stock listing firm, the London Stock Exchange Group.

The biggest shareholder in Marubeni is Berkshire Hathaway – until very recently, the giant group led by legendary investor Warren Buffett, now stepped down from the CEO role.

Within the Japanese firm, the next generation division is focused on company growth through acquisitions – “investments and mergers to get new business”, in the words of one executive, with a new forward-looking focus on consumer businesses, having previously been skewed towards investments, trading and B2B.

Company executives told The Independent that from the first identification of Jacobson as a target to the deal being completed was just three months.

Gola the standout – but not where you think

Gola may turn out to be the jewel in the crown – but it wasn’t initially the main attraction and was, if anything, a brand Marubeni executives only discovered the importance of during the analysis and diligence process.

“When Jacobson came on the radar, we found this established brand out of the UK, and it fits our strategy,” explained Marubeni’s chief operating officer, Toshihiro Fukumura, to The Independent.

“We see the clear trend in retro and heritage sneakers, so it was a perfect fit – and we decided to jump in and make a full swing on the transaction.”

Given the financial power and global spread of the new owners, it’s clear they will have the capacity to push whichever brands they wish into the public eye, in whichever market they see fit.

And it’s not necessarily in the UK where the first major impact could be – with a US-based subsidiary, RG Barry, the actual company within Marubeni, which will house and distribute Gola and other footwear brands.

“Retro is a real trend – it’s happening everywhere, Japan, the US, UK and Europe. But what we’re finding is nuances are slightly different in each region,” said Mr Fukumura.

“In the US it’s fashionable retro brands which are more skewed towards women, not men. Gola shoes are actually gaining popularity among women in the US.

“In the UK it’s the same trend for retro, but consumers look more towards authenticity – it’s difficult to explain but it’s clearly different to the trend in the US. We would like to revitalise Gola’s brand focusing on this retro trend in the UK, but we understand it requires time and effort – we need analysis and to have customised designs to be more appealing to British consumers, relative to current competitors.”

Jacobson had previously reported a rise of 38 per cent in sales in 2024, which Gola contributed significantly towards as its popularity surged once more, with last year having been expected to show increased revenue growth of 40 per cent.

Gola will be pushed to the “main target market” in the US as well as attempting to be “revitalised” in the UK.

The future

Integration of the newly purchased brand is already underway – but the deal-making is far from over, with “active transactions” on the go while Gola and the gang are repositioned within RG Barry.

“This is a long-term play. We want to grow Gola – we are different to some private equity firms, who have to exit – they have to acquire and sell. We have our strategy which is very much long term,” said Mr Fukumura.

There will soon be other brands you’re familiar with coming out of the very same company; only last week, licensing rights were secured for certain products under the Clarks and Timberland brand names, both familiar sights on UK high streets. This week, Japanese beauty brand Etvos was added to the Marubeni mix, further expanding the aggressive push into consumer businesses.

But the 120-year-old Gola, and other brands from Jacobson, are the first. They will set the path for the expansion Marubeni want.

Now, whether consumers come to see Gola as a brand for “now” again – or merely one for a certain age group to look back fondly at – will determine the success of the strategy and, perhaps, how frequently the iconic logo is seen on the streets.