Finance Minister Nirmala Sitharaman presented her 7th budget in which she announced some changes in the new tax slabs while the old remain untouched. FM Sitharaman also proposed a long-term capital gain tax rate of 12.5% on all financial and non-financial assets including properties. Listed financial assets held for more than a year will be classified as long-term, while unlisted financial assets and all non-financial assets will have to be held for at least two years to be classified as long-term.

“Long-term gains on all financial and non-financial assets, on the other hand, will attract a tax rate of 12.5 per cent. For the benefit of the lower and middle-income classes, I propose to increase the limit of exemption of capital gains on certain financial assets to Rs 1.25 lakh per year,” said the FM. The Finance Minister also announced to remove the indexation clause for the ease of tax computation. However, this will prove detrimental for the property sellers. Indexation is used to adjust the property price at the time of sale to account for inflation.

Check Property Sale LTCG Calculation Here

The Congress party shared a detailed calculation showing how LTCG reduction without indexation is not good news for people. “Suppose you bought an apartment in January 2009 for Rs 50 lakhs. Fifteen years later, you sold it today for Rs 1.5 crore. With indexation, the Rs 50 lakhs you paid 15 years ago is considered to be worth Rs 1.32 crore today. So, the net profit or capital gain is only Rs 17.5 lakhs, and you’d pay only Rs 3.5 lakhs as Capital Gains Tax at the rate of 20%. But without indexation, your capital gain now is Rs 1 crore, and at 12.5%, you’d end up paying Rs 12.5 lakhs in tax. Essentially, the government takes Rs 9 lakhs more than the old method,” it said.

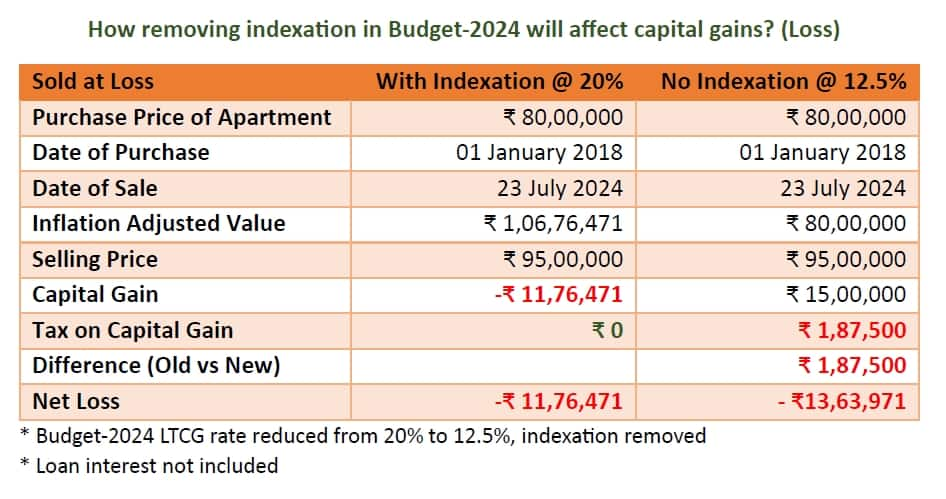

It further clarified that if you bought an apartment in January 2018 for Rs 80 lakhs and sold it today for Rs 95 lakhs due to a personal emergency. “This is where it gets tough. If indexation was applicable, you actually made a loss of Rs 11.76 lakhs and would have paid ‘Zero’ LTCG tax. But with the new method, Nirmala Sitharaman will add salt to your wound. She will take Rs 1.87 lakhs from you as LTCG. Your net loss becomes Rs 13.63 lakhs,” it said.

For those unfamiliar with the Cost Inflation Index (CII), it shows how the value of Rs 100 in 2001-02 is now Rs 363.

LTCG to Loot Middle Class | How will removing indexation in calculating LTCG tax affect everyone?

Today, FM @nsitharaman reduced Long Term Capital Gains (LTCG) Tax on properties to 12.5%, but cleverly removed indexation, which adjusts the property price at the time of sale, to… pic.twitter.com/6uaYjtIaDP

— Congress Kerala (@INCKerala) July 23, 2024

The Income Tax Department also shared a test calculation scenario where it claimed that people will save taxes due to removal of the indexation.

Taxation of Capital Gains – Salient Points

Holding period has been simplified. There are only two holding periods, for listed securities, it is one year, for all other assets, it is two years.

Rate for short-term STT paid listed equity, Equity oriented mutual fund and… pic.twitter.com/w1AdvHDInV

— Income Tax India (@IncomeTaxIndia) July 23, 2024

Even experts shared the same concern. They agreed that removing indexation defeats the whole purpose of LTCG. “This affects everyone and will push more people to undervalue their transactions, increasing the use of black money. This makes real estate investments less attractive and could drive our construction sector into an even bigger crisis,” it said.