MUMBAI: RBI is expected to keep policy rates unchanged in its three-day monetary policy committee meet that starts on Monday. Most economists cite resilient growth, benign inflation and external uncertainties as reasons for a pause, even as the tone of RBI’s guidance is likely to be more dovish than the action itself. Some economists, however, see scope for a 25-basis-point (100bps =1 percentage point) cut as inflation could dip below target.

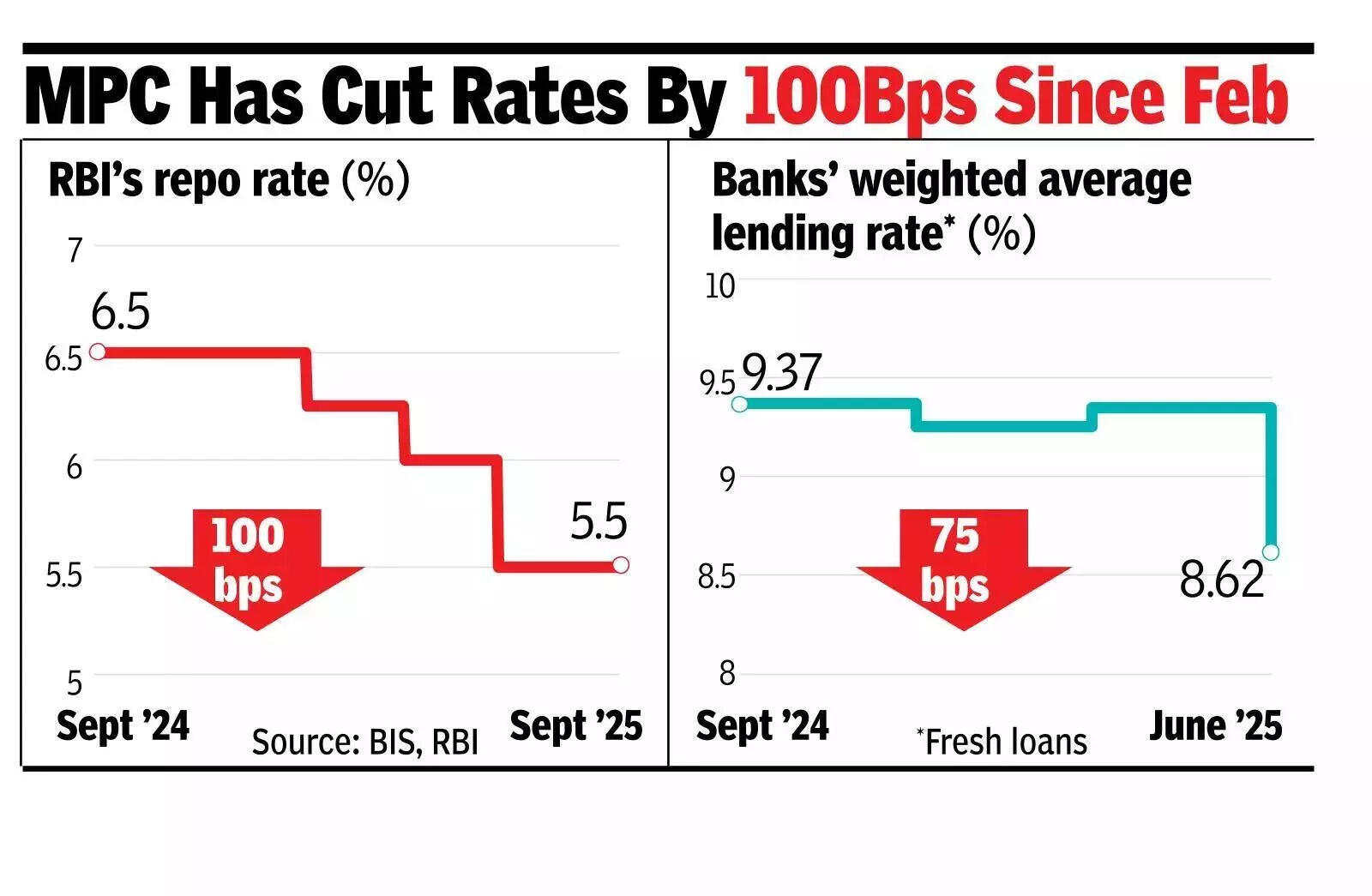

The Oct decision is seen as trickier than Aug, with global and domestic forces pulling in opposite directions. Bond market volatility and a weakening rupee add to the challenge. “The upcoming RBI MPC decision could be a closer call compared to the last MPC meeting,” said Prasanna A of ICICI Securities Primary Dealership. “While we see 35-40% probability of a rate cut, our base case view still remains a pause even as accompanying commentary could tilt the outcome towards a dovish pause.“SBI, in a report, argued for a cut, calling it “the best possible option given the benign inflation trajectory” and said that not cutting rates and retaining a neutral stance would amount to a ‘type 2 error’. RBI cut the repo by 50bps to 5.5% on June 6, the third cut this year – totalling 100bps since Feb.Nomura also expects early easing. “We expect the RBI’s MPC to be forward-looking, especially given the lags in policy transmission,” said Sonal Varma of Nomura. “Our expectation is of 25bps cuts in each of Oct and Dec to a terminal rate of 5% by end-FY26.”Domestically, strong GDP numbers, gradual inflation pick-up and currency pressures argue for a hold. “Against the backdrop of firm growth of over 6.5%, fiscal levers being tapped to boost demand, inflation heading up gradually and the rupee under pressure, we expect the repo rate to be left unchanged,” said Mandar Pitale of SBM Bank (India). “However, cognizant of fresh tariff salvos from the US and risks to growth, we assign a 30% probability for a cut if RBI sees reason in front-loading action.“The US Fed has resumed rate cuts, while India faces higher tariffs and potential secondary sanctions. “We believe high reciprocal tariffs imposed by the US on India and additional secondary sanctions that could subtract growth by up to 1% on an annualised basis is more important information even as trade talks are ongoing,” Prasanna said. RBI may also wait for its earlier steps, such as the Aug CRR (cash reserve ratio) cut, to take effect. “Taking into consideration the overall tone of the minutes of Aug MPC indicating low probability of a rate cut in Oct, MPC is expected to maintain status quo,” said Taimur Baig of DBS Group.